puerto rico tax incentives 2020

However the child tax credit will not be allowed under the IRC to a territory resident if the mirror code tax systems allows a child tax credit against income taxes of the territory. As an attempt to support taxpayers during the COVID-19 pandemic a resolution was ratified in June 2020 to reduce CIT payable by 30 in 2020 for enterprises having annual revenue in 2020 not.

Pr Relocation Guidebook Long Relocate To Puerto Rico With Act 60 20 22

East of Aibonito and Salinas.

. Decorated in 2020 SOLD AS IS Size 2500 sq. Just keep in mind that to qualify for these generous incentives you must become a bona fide resident of Puerto Rico which involves spending the. Schiff has a well-known aversion to paying taxes and lives in Puerto Rico where many wealthy Americans benefit from special tax incentives known as Act 60.

100 tax exemption from Puerto Rico income taxes on all short-term and long-term capital gains. Decorated in 2020 SOLD AS IS Size 2500 sq. Welcome to the Shell Tax Contribution Report which aims to provide easily accessible and detailed information on Shells corporate income tax payments for 2020.

More importantly the requirements for each program have been adjusted. The various tax incentives for new listings or introductions on an approved securities exchange have been eliminated. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed.

However the withholding tax rate on dividend payments to non-residents has been increased from 10 to 15. These changes to the programs are addressed below. Puerto Rico Real Estate Puerto Rico Luxury Real Estate 4 Sale.

Officially Cayey de Muesas is a mountain town and municipality in central Puerto Rico located on the Sierra de Cayey within the Central Mountain range north of Salinas and Guayama. Corporations established in the past ten years or less with carryforward losses and that are not a subsidiary of a large corporation is 40 of the corporate tax liability while the rate of 25 is. Tax Incentives ACT 27.

The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021. Inbound investment incentives. Dorado Beach Lifestyle.

Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. Tax Incentives ACT 27.

Former Puerto Rico Governor Wanda Vázquez was arrested on Thursday on bribery charges related to the financing of her 2020 campaign marking the first time that a former leader of the island faces federal charges. South of Cidra and Caguas. For taxable years beginning after 12312020 a Puerto Rico bona fide resident may claim a fully refundable child tax credit by filing a return with the IRS.

This report builds on the information Shell discloses in its Annual Report and Accounts Sustainability Report and Payments to Governments Report. Subsequent legislation was enacted to address the continued economic impact of the COVID-19. Corporation tax rate reduced from 30 to 25 effective 1 st January 2020.

Moving to Puerto Rico. We have the most exclusive inventory in Beachfront Properties in Puerto Rico. In addition the tax credit limitation for certain RD venture corporations ie.

Moving to Puerto Rico. The 15 tax rate for companies operating a. And west of San LorenzoCayey is spread over 21 barrios plus Cayey Pueblo the downtown area and the.

Tax incentives are granted based on regulated encouraged sectors encouraged locations and size of the projects. The Why of Puerto Ricos Tax Incentives. 100 tax exemption from Puerto Rico income taxes on all cryptocurrencies and other crypto assets.

In 2019 approximately 67000 persons died of violence-related injuries in the United StatesThis report summarizes data from CDCs National Violent Death Reporting System NVDRS on violent deaths that occurred in 42 states the District of Columbia and Puerto Rico in 2019. A week before former governor of Puerto Rico Wanda Vázquez was arrested by the FBI on bribery charges pop superstar Bad Bunny riled up a throng of concertgoers in San Juan calling out the. Beachfront Real Estate Puerto Rico Puerto Rico Beachfront Real Estate Puerto Rico mls listings.

You dont need to join the 2022 Act Society to sign up for the MCS health insurance plan but membership does come with several additional benefits for decree holders of Puerto Rico tax incentives. Two other unidentified people were arrested along with her said an official who was not authorised to talk about the federal case. As originally passed the ERC was available to eligible employers from March 13 2020 to December 31 2020 and was equal to 50 of up to 10000 in qualified wages paid to an employee credit opportunity of 5000 per employee for the 2020 tax year.

This is a health insurance plan from the 2022 Act Society a society created by and for the recipients of Puerto Ricos many tax incentives.

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Gringo Go Home Posters In Puerto Rico Compare Crypto Millionaires Logan Paul And Brock Pierce To Colonizers As The Island S Cost Of Living Soars

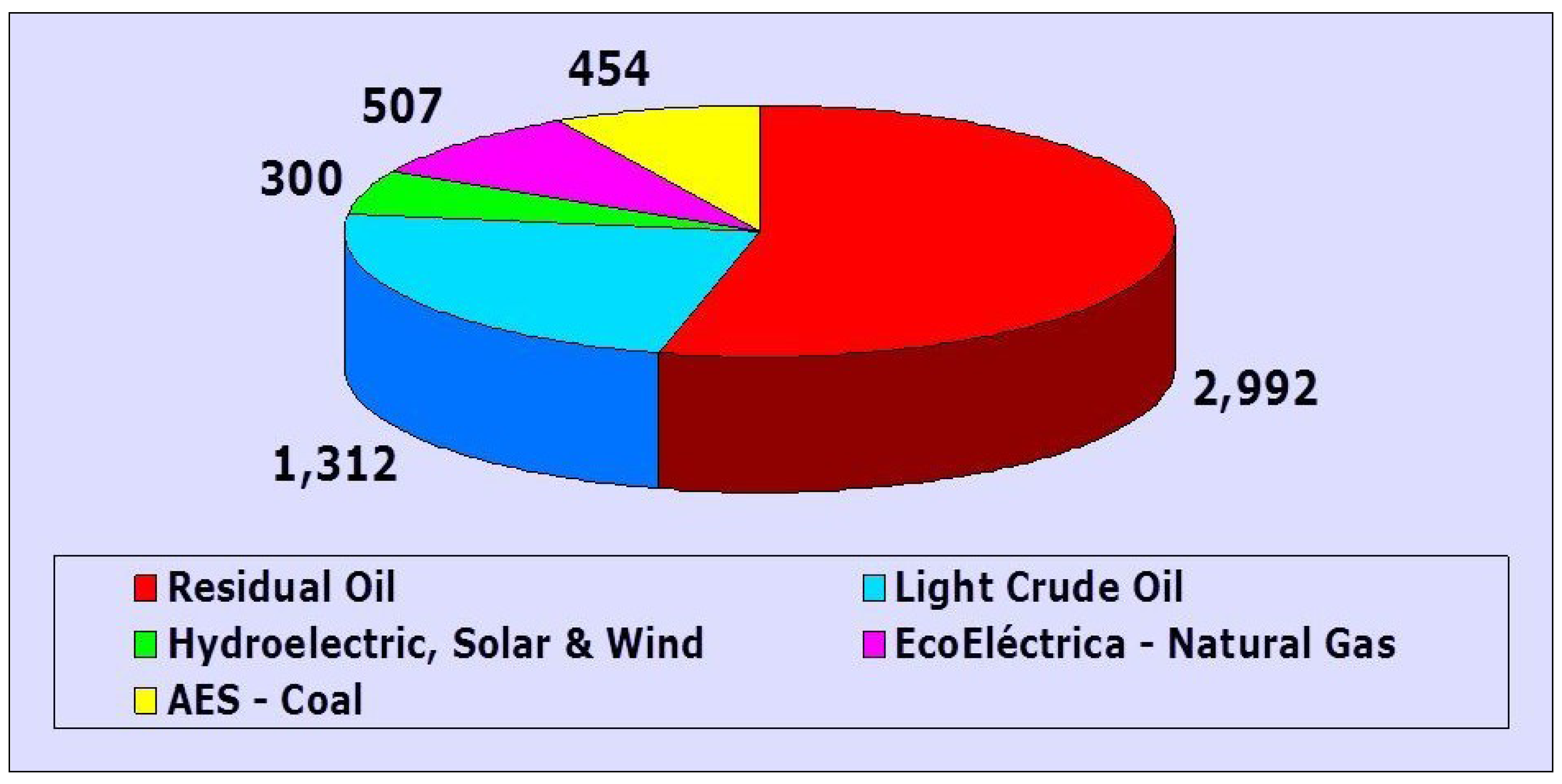

Sustainability Free Full Text Energy Recovery From Scrap Tires A Sustainable Option For Small Islands Like Puerto Rico Html

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Everything You Need To Know About Puerto Rico Tax Incentives Epgd Business Law

Opinion Puerto Rico S Debt Must Be Audited Now The Hill

Group Topples Conquistador Statue In Puerto Rico Calls For Repeal Of Tax Incentives For Foreigners Latino Rebels

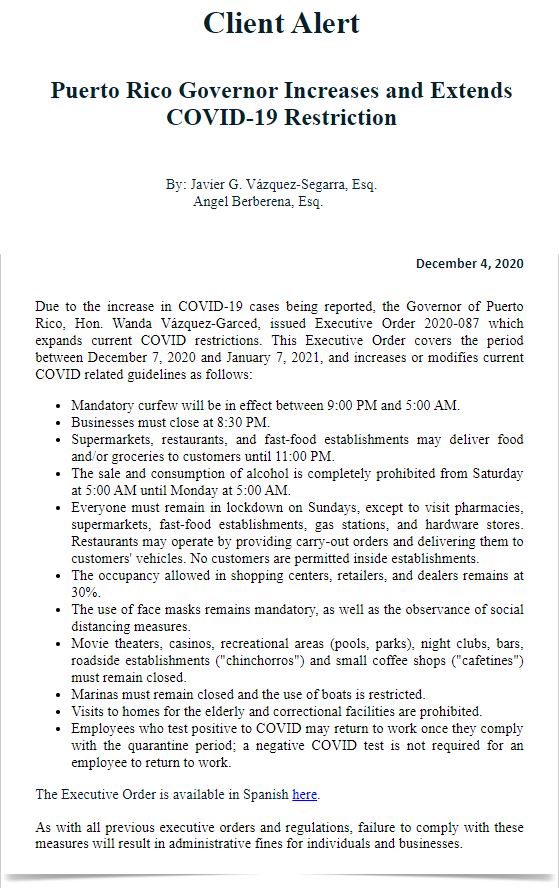

News Publications Goldman Antonetti Cordova Llc San Juan

News Publications Goldman Antonetti Cordova Llc San Juan

News Publications Goldman Antonetti Cordova Llc San Juan

Deciphering Puerto Rico S Debt Crisis Council On Foreign Relations

Guaynabo Your Puerto Rico Real Estate Neighborhood Overview Relocate To Puerto Rico With Act 60 20 22

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

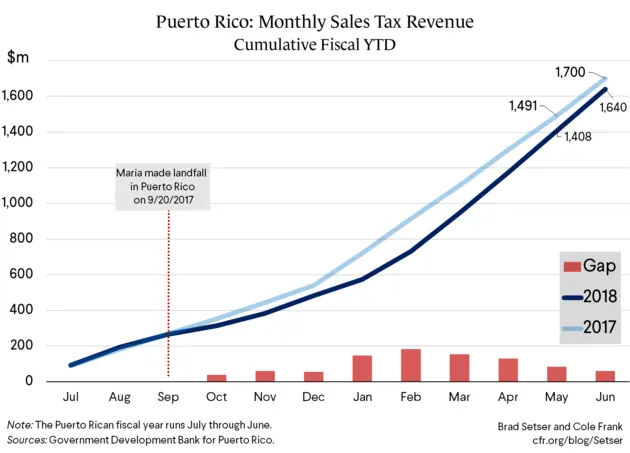

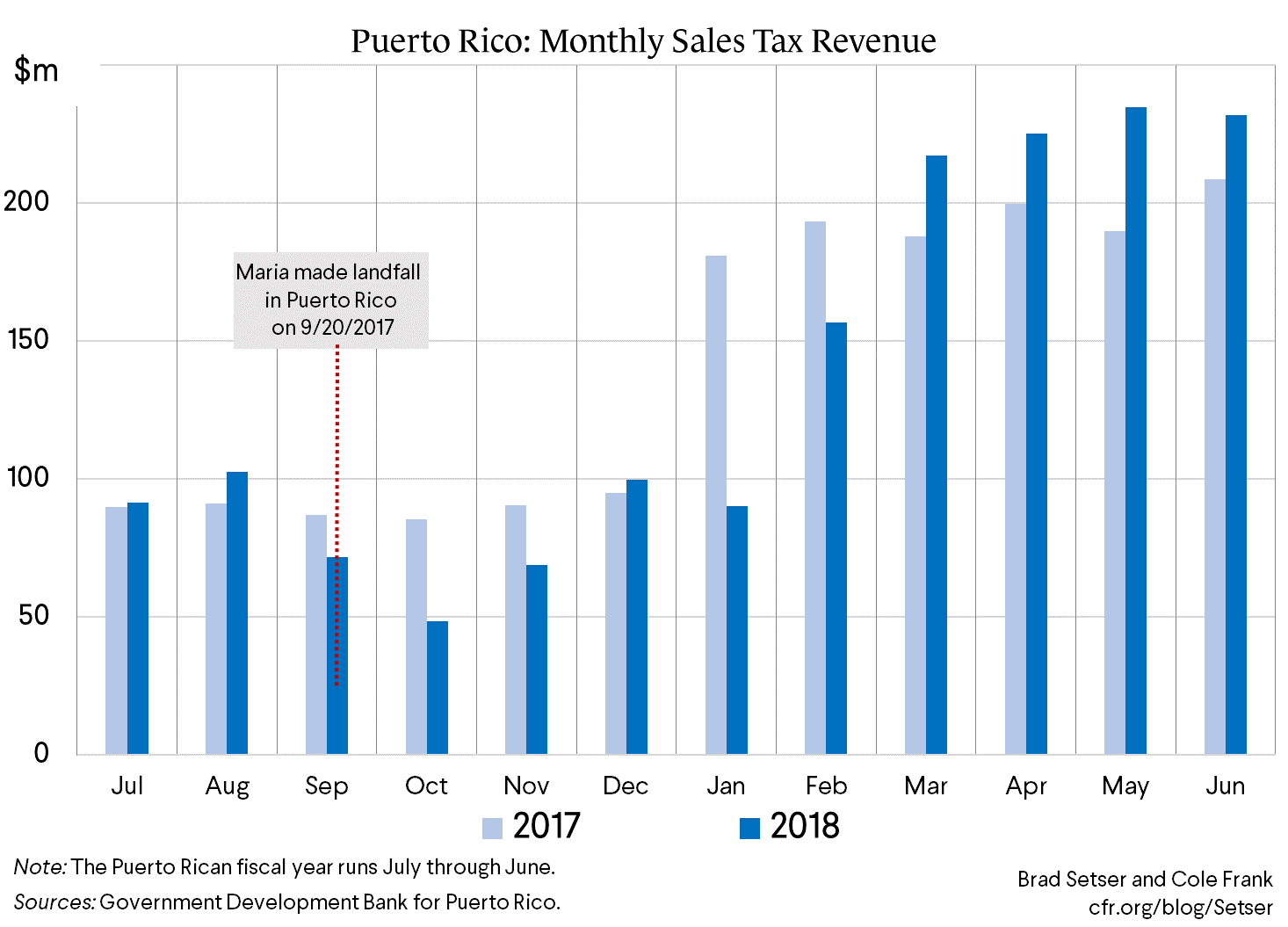

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Puerto Rico Tax Incentives Defending Act 60 Youtube

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Looking Back On Fiscal 2018 As Puerto Rico Starts A New Fiscal Year Council On Foreign Relations